Robot revolution: Cobots march towards c$30bn market

The rise of collaborative robots (cobots) – driven by AI, machine vision, and modular designs – are revolutionising smart factories by enhancing human-robot collaboration, achieving over 95 per cent accuracy in tasks and targeting a $29.8 billion market by 2035, Cambridge's IDTechEx reveals.

IDTechEx Senior Technology Analyst Yulin Wang says the markets should embrace and not fear the automation upspin, fired by combining human ingenuity with robotic precision.

Advancements to date already result in a 25 per cent reductions in downtime, while modular designs and software upgrades ensure adaptability, Wang says and as the market soars cobots are poised to dominate smart factories, driving efficiency, safety, and customisation across industries.

In its report, 'The Rise of Collaborative Robots: Technical and Commercial Insights,' IDTechEx says growth in the market is enormous – from $1.2bn in 2023 to the projected $29.8bn in 10 years from now at a CAGR of 34.5 per cent based on IDTechEx analysis.

Wang says that, unlike traditional industrial robots which operate in isolated, caged environments for safety, cobots work alongside humans, enhancing flexibility and reducing downtime. This shift aligns with Industry 5.0, emphasising human-machine synergy, personalisation, and smart factory ecosystems driven by artificial intelligence, machine vision and reshoring trends (a movement favoured by the Trump administration).

Industry 5.0 prioritises human-robot collaboration, moving beyond Industry 4.0’s automation focus. Cobots enable this by performing tasks requiring precision and speed while humans handle decision-making and customisation.

In automotive manufacturing, companies like BMW and Ford have integrated cobots into assembly lines, reducing cycle times by up to 20 per cent and cutting operational costs by 15 per cent, says Wang.

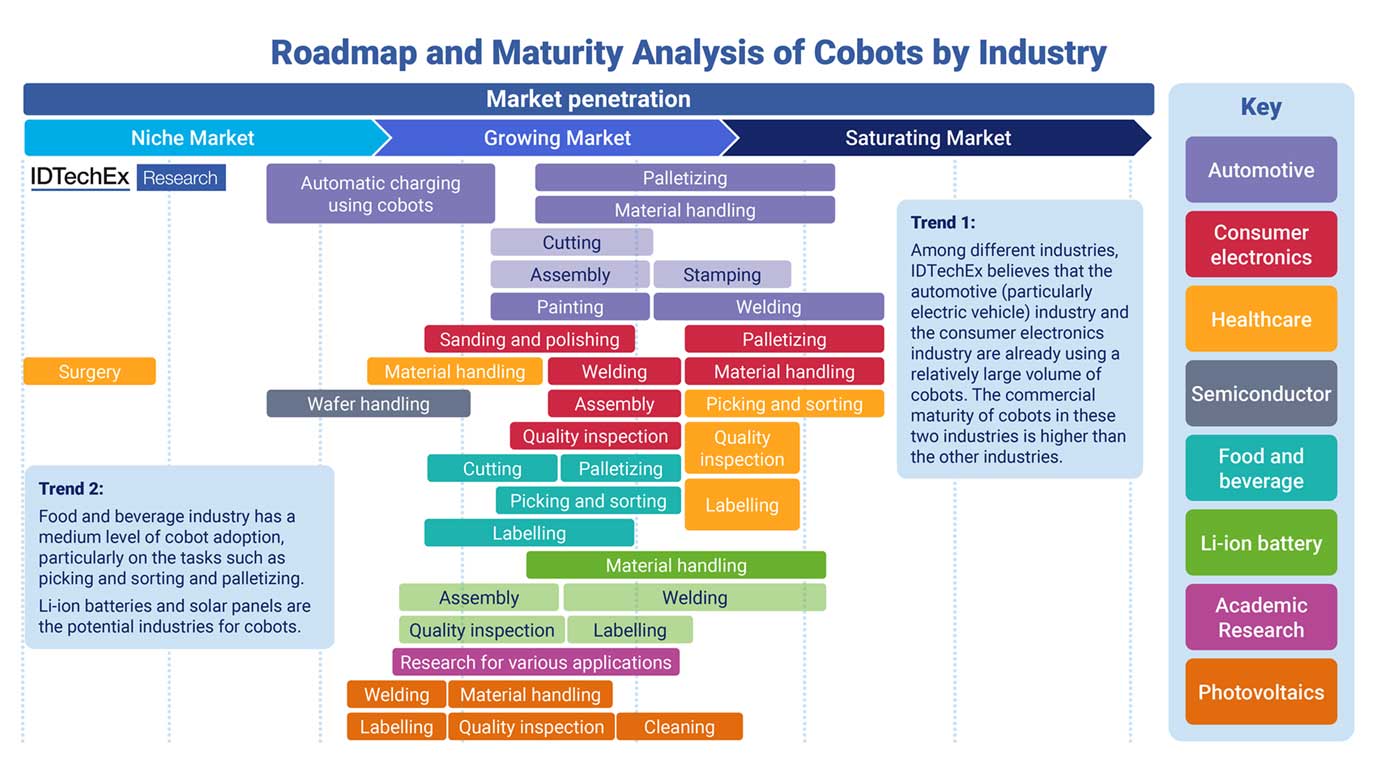

Beyond automotive, electronics (e.g., microchip assembly, wafer transportation), food and beverage (e.g., packaging), and healthcare (e.g., lab automation) sectors are adopting cobots, with over 60 per cent of global cobot deployments occurring in these industries. This versatility drives cobot demand, with 73,000 units shipped globally in 2025 – a 31 per cent increase from 2024.

Wang says that machine vision is critical to cobot functionality, enabling real-time object recognition and environmental adaptation. High-resolution RGB and time-of-flight (ToF) cameras, like those in TM Robot’s cobots, capture 2D and 3D data, achieving object recognition accuracy of 95 per cent and depth measurement errors below 10 per cent.

In electronics, cobots with vision systems inspect microchips, reducing defect rates by 30 per cent compared to human inspection, Wang adds. ToF sensors create detailed depth maps, enabling complex tasks like 3D surface defect detection and collision avoidance. For mobile cobots, vision systems integrate with lidar and ultrasonic sensors, ensuring safe navigation in dynamic environments, with obstacle detection response times under 100ms.

Wang says that AI enhances cobots’ decision-making and interaction capabilities. Deep learning algorithms, trained on datasets of 10,000+ images, enable cobots to recognise diverse objects with 98 per cent accuracy – critical for warehouse automation where occlusion challenges arise (e.g., overlapping items in bins).

Natural language processing (NLP) allows cobots to process verbal commands, though ambient noise reduces accuracy by 15 per cent in factory settings (MIT, 2025). Advanced AI models, like those on NVIDIA’s Jetson platform, process 1TB/s of sensor data, enabling real-time adaptive workflows and predictive maintenance, which cuts downtime by 25 per cent (Nvidia, 2024). Universal Robots’ PolyScope X platform, leveraging NVIDIA's Isaac libraries, supports complex tasks like autonomous path planning, with a 40 per cent improvement in task efficiency, Wang says.

Cobot advancements stem from modular hardware and software upgrades rather than new physical designs. Sensor arrays (cameras, ToF, lidar) cost $500-$2,000 per unit, while NVIDIA Jetson modules ($400-$1,200) provide the computational power for AI tasks, the report author adds.

Modular end-of-arm tooling (EoAT), priced at $1,000-$5,000, allows task-specific customisation, such as precision grippers for healthcare applications like medical device assembly. Software platforms, like Universal Robots’ PolyScope, optimise data processing, reducing latency by 30 per cent for real-time applications. These innovations enable cobots to integrate seamlessly into existing production lines, with setup times reduced to 2-4 hours, says Wang.

According to the author, the cobot market’s growth is driven by cost savings and flexibility. A single cobot, priced at $20,000-$40,000, offers end-users a 12-30 months return on investment (ROI), compared to 36-60 months for traditional robots.

Due to their controlled environments, the electronics and automotive sectors lead adoption, accounting for 55 per cent of the market share.

Reshoring trends, particularly in the US and EU, boost demand, with 70 per cent of manufacturers planning to integrate cobots by 2030 to reduce labour costs, which average $25/hour in developed markets. This transition is expected to push the adoption of cobots.

For more information on the IDTechEx report, including downloadable sample pages, visit www.IDTechEx.com/Cobots